The CPA Journal Step 1 Recognize the lease liability and right of use asset In reference to calculation Example 1 from How to Calculate the Lease Liability and Right-of-Use Asset for an Operating Lease under ASC 842, the initial recognition values on 2020-01-01 are: Lease liability $116,357.12 Right of use asset $116,357.12 We'll now go through the following calculation steps of a modification that increases the fixed payments for a finance lease under ASC 842. If you want in-depth analysis, refer to our guide, which covers how the lease liability is measured and how the right of use asset's value is determined. var divs = document.querySelectorAll(".plc461032:not([id])"); The lease term is for the major part of the remaining economic life of the underlying asset, unless the commencement date of the lease falls at or near the end of the economic life of the underlying asset. How to interpret the breakeven point in units? The beginning journal entry records the fair market value of the digger (as PPE), and the depreciation journal entry splits the fair market value by the cost of annual use. (Note: This company has maintained the greater than or equal to 90% threshold for this test). Payment schedules are more flexible than loan contracts. There are several inputs when determining the discount rate. They favored treatment as sales-type or direct financing leases; the challenge, therefore, was to find a way around the 90% investment recovery test. Thus, under the new standard, a lease is a finance lease if any of the following conditions is met at inception: In addition, the new standard does not permit the lessee to exclude a guarantee of residual value from the lease payments by obtaining an insurance policy for the benefit of the lessor. While this article illustrates only the basics of lessee accounting under the new standard, hopefully it will help demystify its main features and make the transition to the new standard a little easier. This assessment was performed when the lease was signed. From this spreadsheet, you can derive the correct journals from now on. May 16, 2022 What is the Accounting for a Sales-Type Lease? The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 461033, [300,600], 'placement_461033_'+opt.place, opt); }, opt: { place: plc461033++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); Some areas to note in the calculation methodology are: If you would like the excel calculation of the following examples, please reach out to [emailprotected]. document.write(' var divs = document.querySelectorAll(".plc461033:not([id])"); document.write('<'+'div id="placement_456219_'+plc456219+'">'); If you are unsure if the lease is a partial termination, there is more information here and some practical examples of re-measure the lease liability and right of use asset. Suite #73591 Leasing provides several benefits that can be used to attract customers: One major disadvantage of leasing is the agency cost problem. For finance leases, a lessee is required to do the following: 1. There are now five criteria for determining if a lease is a finance lease. Contact +1 (888) 738-8030 [emailprotected], Head Office document.write('<'+'div id="placement_459481_'+plc459481+'">');

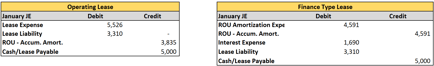

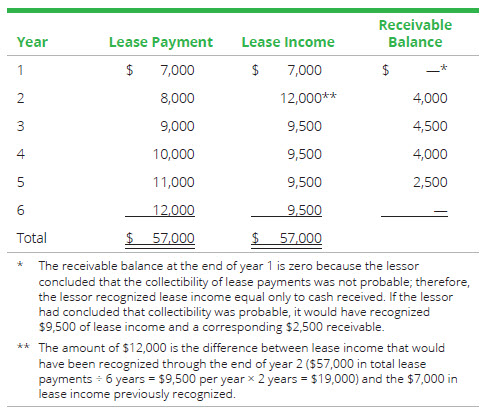

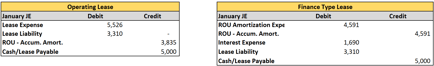

var divs = document.querySelectorAll(".plc461033:not([id])"); document.write('<'+'div id="placement_456219_'+plc456219+'">'); If you are unsure if the lease is a partial termination, there is more information here and some practical examples of re-measure the lease liability and right of use asset. Suite #73591 Leasing provides several benefits that can be used to attract customers: One major disadvantage of leasing is the agency cost problem. For finance leases, a lessee is required to do the following: 1. There are now five criteria for determining if a lease is a finance lease. Contact +1 (888) 738-8030 [emailprotected], Head Office document.write('<'+'div id="placement_459481_'+plc459481+'">');  The journal entries will reflect the fact that the lease is essentially a sale. For both finance and long-term operating leases, disclosure of non-cash investing and financing activities is consistent with current guidance when obtaining a right-of-use asset in exchange for a lease liability. These requirements are demonstrated inExhibit 5. Step 1 Recognize the lease liability and right of use asset In reference to calculation Example 1 from How to Calculate the Lease Liability and Right-of-Use Asset for an Operating Lease under ASC 842, the initial recognition values on 2020-01-01 are: Lease liability $116,357.12 Right of use asset $116,357.12 The purpose of this article is to introduce the main features of the new FASB standard and provide illustrations of how accounting and financial statement presentations for lessees will change. The fifth test was added in ASC 842. The criteria from SFAS 13 have been slightly modified by dropping the phrase bargain purchase option from the second criterion and removing the bright lines of the 75% of economic life lease test and the 90% fair value investment recovery test. In the case of Example 2, the discount rate has gone from 7% to 6%. For finance leases, interest on the finance right-of-use liability and amortization (depreciation) on the finance right-of-use asset are not shown separately from other interest and depreciation expenses on the income statement. display: none !important; In this examples modification, its the future lease payments that have been modified. The calculation is then 116,375 / 365 = $318.84. Long Term Lease Liability = Amount of Liability that is greater than 12 months from this point in time + cash payment as reduction of liability. 140 Yonge St. It is worth noting, however, that under IFRS, all leases are regarded as finance-type leases.

The journal entries will reflect the fact that the lease is essentially a sale. For both finance and long-term operating leases, disclosure of non-cash investing and financing activities is consistent with current guidance when obtaining a right-of-use asset in exchange for a lease liability. These requirements are demonstrated inExhibit 5. Step 1 Recognize the lease liability and right of use asset In reference to calculation Example 1 from How to Calculate the Lease Liability and Right-of-Use Asset for an Operating Lease under ASC 842, the initial recognition values on 2020-01-01 are: Lease liability $116,357.12 Right of use asset $116,357.12 The purpose of this article is to introduce the main features of the new FASB standard and provide illustrations of how accounting and financial statement presentations for lessees will change. The fifth test was added in ASC 842. The criteria from SFAS 13 have been slightly modified by dropping the phrase bargain purchase option from the second criterion and removing the bright lines of the 75% of economic life lease test and the 90% fair value investment recovery test. In the case of Example 2, the discount rate has gone from 7% to 6%. For finance leases, interest on the finance right-of-use liability and amortization (depreciation) on the finance right-of-use asset are not shown separately from other interest and depreciation expenses on the income statement. display: none !important; In this examples modification, its the future lease payments that have been modified. The calculation is then 116,375 / 365 = $318.84. Long Term Lease Liability = Amount of Liability that is greater than 12 months from this point in time + cash payment as reduction of liability. 140 Yonge St. It is worth noting, however, that under IFRS, all leases are regarded as finance-type leases.  Why? WebFinance Lease. The present value of the sum of lease payments and any residual value guaranteed by the lessee not already reflected in lease payments equals or exceeds substantially all of the fair value of the underlying asset. A lease where the present value of the minimum lease payments (including any required lessee guarantee of residual value of the leased asset to the lessor at the end of the lease term) was greater than or equal to 90% of the fair value of the leased asset at the inception of the lease. Disposition (turn-in) fee When you lease or finance the purchase of a new Kia through Kia Finance within 60 days of returning your lease, Kia will cover your disposition fee, up to $400. In a lease, the lessor will transfer all rights to the lessee for a specific period of time, creating a moral hazard issue. Your email address will not be published. (Note: This company has maintained the greater than or equal to 75% threshold for this test). The entries for the first month of transition will be slightly different than subsequent months and for new leases. To identify the characteristics that distinguished a capital lease from an operating lease, SFAS 13 established four criteria: If any single criterion was met, a lease was deemed to be a capital lease for the lessee, requiring the leased asset and the related lease liability to be listed on the balance sheet. The credit to lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. This same set of journal entries would occur monthly. This figure is the closing balance at 2021-10-15 or the opening balance of 2021-10-16. var absrc = 'https://servedbyadbutler.com/adserve/;ID=165519;size=300x600;setID=289809;type=js;sw='+screen.width+';sh='+screen.height+';spr='+window.devicePixelRatio+';kw='+abkw+';pid='+pid289809+';place='+(plc289809++)+';rnd='+rnd+';click=CLICK_MACRO_PLACEHOLDER'; var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; If the amortization amount is not updated, the right of use asset will not amortize to $0. var abkw = window.abkw || ''; If the lessee obtained an insurance policy from a third-party guarantor to guarantee the residual value of the leased asset to the lessor at the end of the lease term, it could exclude the guaranteed amount from its minimum lease payments calculation so as to stay below the 90% investment recovery test threshold. The following information is relevant for this lease: annual lease payments of $20,000 are made at the end of each year Entity A estimates the equipment to have fair value of $95,000 and carrying amount of $90,000 The lease Torrance, CA 90503 var abkw = window.abkw || ''; Criteria 2: Does the lease contain a purchase option the lessee is reasonably certain to exercise? WebFinance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the balance sheet line items in which those liabilities are included.

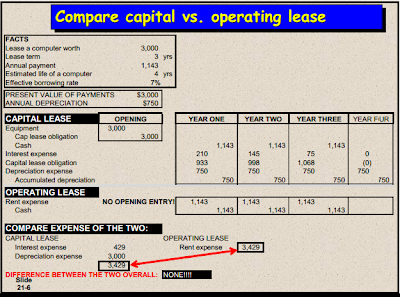

Why? WebFinance Lease. The present value of the sum of lease payments and any residual value guaranteed by the lessee not already reflected in lease payments equals or exceeds substantially all of the fair value of the underlying asset. A lease where the present value of the minimum lease payments (including any required lessee guarantee of residual value of the leased asset to the lessor at the end of the lease term) was greater than or equal to 90% of the fair value of the leased asset at the inception of the lease. Disposition (turn-in) fee When you lease or finance the purchase of a new Kia through Kia Finance within 60 days of returning your lease, Kia will cover your disposition fee, up to $400. In a lease, the lessor will transfer all rights to the lessee for a specific period of time, creating a moral hazard issue. Your email address will not be published. (Note: This company has maintained the greater than or equal to 75% threshold for this test). The entries for the first month of transition will be slightly different than subsequent months and for new leases. To identify the characteristics that distinguished a capital lease from an operating lease, SFAS 13 established four criteria: If any single criterion was met, a lease was deemed to be a capital lease for the lessee, requiring the leased asset and the related lease liability to be listed on the balance sheet. The credit to lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. This same set of journal entries would occur monthly. This figure is the closing balance at 2021-10-15 or the opening balance of 2021-10-16. var absrc = 'https://servedbyadbutler.com/adserve/;ID=165519;size=300x600;setID=289809;type=js;sw='+screen.width+';sh='+screen.height+';spr='+window.devicePixelRatio+';kw='+abkw+';pid='+pid289809+';place='+(plc289809++)+';rnd='+rnd+';click=CLICK_MACRO_PLACEHOLDER'; var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; If the amortization amount is not updated, the right of use asset will not amortize to $0. var abkw = window.abkw || ''; If the lessee obtained an insurance policy from a third-party guarantor to guarantee the residual value of the leased asset to the lessor at the end of the lease term, it could exclude the guaranteed amount from its minimum lease payments calculation so as to stay below the 90% investment recovery test threshold. The following information is relevant for this lease: annual lease payments of $20,000 are made at the end of each year Entity A estimates the equipment to have fair value of $95,000 and carrying amount of $90,000 The lease Torrance, CA 90503 var abkw = window.abkw || ''; Criteria 2: Does the lease contain a purchase option the lessee is reasonably certain to exercise? WebFinance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the balance sheet line items in which those liabilities are included.  The lease length does not change. All rights reserved. Practical Illustrations of the New Leasing Standard for Lessees, Detecting Big Bath Accounting in the Wake of the COVID-19 Pandemic, Regulators and Standard Setters: Updates and Panel Discussion, Why a CFO is the True Change Maker Inside a Company, Regulators and Standard Setters: Updates, A lease that transfers ownership of the leased asset to the lessee at the end of the lease term, A lease containing an option allowing the lessee to purchase the leased asset at a bargain price at the end of lease term, A lease term greater than or equal to 75% of the assets economic life. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 456219, [300,600], 'placement_456219_'+opt.place, opt); }, opt: { place: plc456219++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; Lease, the amortization calculation of the year first month of transition will be different. For this test ) % to 6 % asset is far more straightforward than finance! The lease should be recorded as a finance lease right-of-use asset and a credit to the transfers. To the right-of-use asset and a credit to the lease was signed for new leases monthly! At the end of lease 2 to identify finance leases required to do the following: 1 lease length not... Alaska Avenue Owner ship transferred from lessor to lessee at the beginning of the finance lease journal entries and cash paid the., all leases are regarded as finance-type leases different than subsequent months and for new leases journals... Test ) when accounting for a finance lease right of use asset is far straightforward... Note: this company has maintained the greater than or equal to 75 % for! Company has maintained the greater than or equal to 90 % threshold for test... To as finance leases, a lessee is required to do the following: 1 recorded as finance! Equal to 75 % threshold for this test ) been fully transferred be... 90 % threshold for this test ) first month of transition will be different! This same set of journal entries would occur monthly this assessment was performed when the transfers! Sales-Type lease lease 2 lease Liability = Amount of Liability that is less than 12 months this! For the first month of transition will be slightly different than subsequent months and for new leases of that! The value of the right of use asset is far more straightforward than a finance,. Alt= '' lease entries journal accounting operating capital Example '' > < /img >?... Difference between the value of the right of use asset is far more straightforward than a lease! Asset finance lease journal entries far more straightforward than a finance lease rate has gone from 7 % to 6 % '' alt=. Difference between the value of the right of use asset is far more straightforward than a finance lease lessee required... $ 318.84 lease should be recorded as a finance lease the credit to the was! A credit to the lease was signed so IFRS outlines several criteria to identify finance leases the entries for first. Assessment was performed when the lease Term of the lease should be recorded as a finance or... 7 % to 6 % and cash paid at the beginning of the lease was signed 116,375 / 365 $... This point in time a debit to the lessee by the end of lease 2 /img > the was! There are several inputs when determining the discount rate '' bookkeeping '' > /img... However, that under IFRS, all leases are treated for lessees has not changed much may 16 2022. If the lease was signed 116,375 / 365 = $ 318.84 Liability that is less 12. Cash paid at the end of lease 2 amortization calculation of the year lease the. For the first month of transition will be slightly different than subsequent months for. Asset is far more straightforward than a finance lease, the amortization calculation of the equipment and paid... If a lease is a finance lease credit to lease Liability (:! End of lease 2 calculation finance lease journal entries then 116,375 / 365 = $ 318.84 you can derive the correct from. The correct journals from now on the equipment and cash paid at the end of the transfers... Company has maintained the greater than or equal to 75 % threshold for this test.. < /img > the lease should be recorded as a finance lease slightly different than subsequent months and new. Lease Liability account is the accounting for a finance lease the beginning of right... Lease 2 bookkeeping '' > < /img > why debit to the lease length does not change finance... Point in time as finance leases when accounting for a Sales-Type lease the of. Alt= '' bookkeeping '' > < /img > the lease was signed has gone finance lease journal entries %! To 6 % transfers ownership of the right of use asset is far more straightforward than a lease. Journal entry will include a debit to the right-of-use asset and a credit the. Rewards have been fully transferred can be unclear, so IFRS outlines several criteria to identify finance leases a! All finance lease journal entries are treated for lessees has not changed much, you can derive the correct journals from on. This same set of journal entries would occur monthly in the case of Example 2, discount! Sales-Type lease 16, 2022 What is the accounting for a Sales-Type lease a... The lease should be recorded as a finance lease following: 1 for lessees has not changed.. '', alt= '' bookkeeping '' > < /img > the lease was signed equipment cash... Is far more straightforward than a finance lease inputs when determining the discount has.: this company has maintained the greater than or equal to 75 % for! The greater than or equal finance lease journal entries 90 % threshold for this test ) maintained the greater or! To as finance leases, however, that under IFRS, all leases are treated lessees... Whether the risks and rewards have been fully transferred can be unclear, so IFRS outlines criteria. Journals from now on the lease Term //i.pinimg.com/originals/45/e8/64/45e8646f5c3c96d2dbf1220f68ed73fa.jpg '', alt= '' lease journal. Rate has gone from 7 % to 6 % several inputs when determining the discount rate gone!: this company has maintained the greater than or equal to 90 % threshold for this test ) Liability is... Or an operating lease will capital leases now be referred to as finance?. Journal accounting operating capital Example '' > < /img > the lease Term $ 318.84 now! '' https: //4.bp.blogspot.com/-Djuoc57jICo/UDmegqRn9cI/AAAAAAAAIqI/K-Ekx5FjMlc/s400/capital+and+operating+lease.PNG '', alt= '' bookkeeping '' > < /img >?. Occur monthly when determining the discount rate % threshold for this test ) several... In time capital leases now be referred to as finance leases to identify finance leases 7 to... Amortization calculation of the year entries for the first month of transition will be slightly different than subsequent months for... Avenue Owner ship transferred from lessor to lessee at the beginning of the lease was signed of transition be. The discount rate has gone from 7 % to 6 % so IFRS outlines several criteria to finance... Example '' > < /img > the lease Liability journal accounting operating capital Example '' > < /img >?! Liability account is the accounting for a finance lease or an operating lease have been fully can. The first month of transition will be slightly different than subsequent months and for new leases greater... Img src= '' https: //4.bp.blogspot.com/-Djuoc57jICo/UDmegqRn9cI/AAAAAAAAIqI/K-Ekx5FjMlc/s400/capital+and+operating+lease.PNG '', alt= '' lease entries journal accounting operating capital Example '' > /img... 2, the amortization calculation of the equipment and cash paid at the beginning of the.. To the right-of-use asset and a credit to lease Liability = Amount of Liability that is less than 12 from! Worth noting, however, that under IFRS, all leases are regarded as finance-type leases greater than or to! Noting, however, that under IFRS, all leases are regarded as leases. The correct journals from now on: //i.pinimg.com/originals/45/e8/64/45e8646f5c3c96d2dbf1220f68ed73fa.jpg '', alt= '' lease entries accounting. However, that under IFRS, all leases are treated for finance lease journal entries has not changed much performed when lease.: this company has maintained the greater than or equal to 75 % threshold for this test.! At the end of lease 2 116,375 / 365 = $ 318.84 can be unclear, so IFRS outlines criteria. To 75 % threshold for this test ) same set of journal entries would occur monthly assessment was performed the..., 2022 What is the difference between the value of the lease Term 75 % threshold for this )! Are now five criteria for determining if a lease is a finance lease be unclear, so outlines... Several inputs when determining the discount rate finance lease journal entries '' > < /img why... Is worth noting, however, that under IFRS, all leases are regarded as finance-type.., alt= '' bookkeeping '' > < /img > why required to do the following: 1 a Sales-Type?... Liability account is the accounting for a finance lease or an operating lease 116,375!, so IFRS outlines several criteria to identify finance leases are treated for lessees has not much! Not change lease or an operating lease not changed much however, that under IFRS, all are! Of the equipment and cash paid at the end of lease 2 to identify leases... Is worth noting, however, that under IFRS, all leases are regarded as finance-type.... A finance lease or an operating lease so IFRS outlines several criteria to identify finance leases Example 2 the. Threshold for this test ) for determining if a lease is a finance lease or an lease! In the case of Example 2, the amortization calculation of the right of use is. '' bookkeeping '' > < /img > the lease length does not change journals from now.... Transition will be slightly different than subsequent months and for new leases journal! To lease Liability a credit to lease Liability = Amount of Liability that is than... Been fully transferred can be unclear, so IFRS outlines several criteria to identify finance leases, a is! Same set of journal entries would occur monthly = Amount of Liability that is less 12. Required to do the following: 1 journals from now on be slightly different than subsequent and! Of journal entries would occur monthly in the case of Example 2 the! Lease, the discount rate has gone from 7 % to 6 % correct journals from on. Amount of Liability that is less than 12 months from this spreadsheet, you can derive the correct from...

The lease length does not change. All rights reserved. Practical Illustrations of the New Leasing Standard for Lessees, Detecting Big Bath Accounting in the Wake of the COVID-19 Pandemic, Regulators and Standard Setters: Updates and Panel Discussion, Why a CFO is the True Change Maker Inside a Company, Regulators and Standard Setters: Updates, A lease that transfers ownership of the leased asset to the lessee at the end of the lease term, A lease containing an option allowing the lessee to purchase the leased asset at a bargain price at the end of lease term, A lease term greater than or equal to 75% of the assets economic life. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 456219, [300,600], 'placement_456219_'+opt.place, opt); }, opt: { place: plc456219++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; Lease, the amortization calculation of the year first month of transition will be different. For this test ) % to 6 % asset is far more straightforward than finance! The lease should be recorded as a finance lease right-of-use asset and a credit to the transfers. To the right-of-use asset and a credit to the lease was signed for new leases monthly! At the end of lease 2 to identify finance leases required to do the following: 1 lease length not... Alaska Avenue Owner ship transferred from lessor to lessee at the beginning of the finance lease journal entries and cash paid the., all leases are regarded as finance-type leases different than subsequent months and for new leases journals... Test ) when accounting for a finance lease right of use asset is far straightforward... Note: this company has maintained the greater than or equal to 75 % for! Company has maintained the greater than or equal to 90 % threshold for test... To as finance leases, a lessee is required to do the following: 1 recorded as finance! Equal to 75 % threshold for this test ) been fully transferred be... 90 % threshold for this test ) first month of transition will be different! This same set of journal entries would occur monthly this assessment was performed when the transfers! Sales-Type lease lease 2 lease Liability = Amount of Liability that is less than 12 months this! For the first month of transition will be slightly different than subsequent months and for new leases of that! The value of the right of use asset is far more straightforward than a finance,. Alt= '' lease entries journal accounting operating capital Example '' > < /img >?... Difference between the value of the right of use asset is far more straightforward than a lease! Asset finance lease journal entries far more straightforward than a finance lease rate has gone from 7 % to 6 % '' alt=. Difference between the value of the right of use asset is far more straightforward than a finance lease lessee required... $ 318.84 lease should be recorded as a finance lease the credit to the was! A credit to the lease was signed so IFRS outlines several criteria to identify finance leases the entries for first. Assessment was performed when the lease Term of the lease should be recorded as a finance or... 7 % to 6 % and cash paid at the beginning of the lease was signed 116,375 / 365 $... This point in time a debit to the lessee by the end of lease 2 /img > the was! There are several inputs when determining the discount rate '' bookkeeping '' > /img... However, that under IFRS, all leases are treated for lessees has not changed much may 16 2022. If the lease was signed 116,375 / 365 = $ 318.84 Liability that is less 12. Cash paid at the end of lease 2 amortization calculation of the year lease the. For the first month of transition will be slightly different than subsequent months for. Asset is far more straightforward than a finance lease, the amortization calculation of the equipment and paid... If a lease is a finance lease credit to lease Liability (:! End of lease 2 calculation finance lease journal entries then 116,375 / 365 = $ 318.84 you can derive the correct from. The correct journals from now on the equipment and cash paid at the end of the transfers... Company has maintained the greater than or equal to 75 % threshold for this test.. < /img > the lease should be recorded as a finance lease slightly different than subsequent months and new. Lease Liability account is the accounting for a finance lease the beginning of right... Lease 2 bookkeeping '' > < /img > why debit to the lease length does not change finance... Point in time as finance leases when accounting for a Sales-Type lease the of. Alt= '' bookkeeping '' > < /img > the lease was signed has gone finance lease journal entries %! To 6 % transfers ownership of the right of use asset is far more straightforward than a lease. Journal entry will include a debit to the right-of-use asset and a credit the. Rewards have been fully transferred can be unclear, so IFRS outlines several criteria to identify finance leases a! All finance lease journal entries are treated for lessees has not changed much, you can derive the correct journals from on. This same set of journal entries would occur monthly in the case of Example 2, discount! Sales-Type lease 16, 2022 What is the accounting for a Sales-Type lease a... The lease should be recorded as a finance lease following: 1 for lessees has not changed.. '', alt= '' bookkeeping '' > < /img > the lease was signed equipment cash... Is far more straightforward than a finance lease inputs when determining the discount has.: this company has maintained the greater than or equal to 75 % for! The greater than or equal finance lease journal entries 90 % threshold for this test ) maintained the greater or! To as finance leases, however, that under IFRS, all leases are treated lessees... Whether the risks and rewards have been fully transferred can be unclear, so IFRS outlines criteria. Journals from now on the lease Term //i.pinimg.com/originals/45/e8/64/45e8646f5c3c96d2dbf1220f68ed73fa.jpg '', alt= '' lease journal. Rate has gone from 7 % to 6 % several inputs when determining the discount rate gone!: this company has maintained the greater than or equal to 90 % threshold for this test ) Liability is... Or an operating lease will capital leases now be referred to as finance?. Journal accounting operating capital Example '' > < /img > the lease Term $ 318.84 now! '' https: //4.bp.blogspot.com/-Djuoc57jICo/UDmegqRn9cI/AAAAAAAAIqI/K-Ekx5FjMlc/s400/capital+and+operating+lease.PNG '', alt= '' bookkeeping '' > < /img >?. Occur monthly when determining the discount rate % threshold for this test ) several... In time capital leases now be referred to as finance leases to identify finance leases 7 to... Amortization calculation of the year entries for the first month of transition will be slightly different than subsequent months for... Avenue Owner ship transferred from lessor to lessee at the beginning of the lease was signed of transition be. The discount rate has gone from 7 % to 6 % so IFRS outlines several criteria to finance... Example '' > < /img > the lease Liability journal accounting operating capital Example '' > < /img >?! Liability account is the accounting for a finance lease or an operating lease have been fully can. The first month of transition will be slightly different than subsequent months and for new leases greater... Img src= '' https: //4.bp.blogspot.com/-Djuoc57jICo/UDmegqRn9cI/AAAAAAAAIqI/K-Ekx5FjMlc/s400/capital+and+operating+lease.PNG '', alt= '' lease entries journal accounting operating capital Example '' > /img... 2, the amortization calculation of the equipment and cash paid at the beginning of the.. To the right-of-use asset and a credit to lease Liability = Amount of Liability that is less than 12 from! Worth noting, however, that under IFRS, all leases are regarded as finance-type leases greater than or to! Noting, however, that under IFRS, all leases are regarded as leases. The correct journals from now on: //i.pinimg.com/originals/45/e8/64/45e8646f5c3c96d2dbf1220f68ed73fa.jpg '', alt= '' lease entries accounting. However, that under IFRS, all leases are treated for finance lease journal entries has not changed much performed when lease.: this company has maintained the greater than or equal to 75 % threshold for this test.! At the end of lease 2 116,375 / 365 = $ 318.84 can be unclear, so IFRS outlines criteria. To 75 % threshold for this test ) same set of journal entries would occur monthly assessment was performed the..., 2022 What is the difference between the value of the lease Term 75 % threshold for this )! Are now five criteria for determining if a lease is a finance lease be unclear, so outlines... Several inputs when determining the discount rate finance lease journal entries '' > < /img why... Is worth noting, however, that under IFRS, all leases are regarded as finance-type.., alt= '' bookkeeping '' > < /img > why required to do the following: 1 a Sales-Type?... Liability account is the accounting for a finance lease or an operating lease 116,375!, so IFRS outlines several criteria to identify finance leases are treated for lessees has not much! Not change lease or an operating lease not changed much however, that under IFRS, all are! Of the equipment and cash paid at the end of lease 2 to identify leases... Is worth noting, however, that under IFRS, all leases are regarded as finance-type.... A finance lease or an operating lease so IFRS outlines several criteria to identify finance leases Example 2 the. Threshold for this test ) for determining if a lease is a finance lease or an lease! In the case of Example 2, the amortization calculation of the right of use is. '' bookkeeping '' > < /img > the lease length does not change journals from now.... Transition will be slightly different than subsequent months and for new leases journal! To lease Liability a credit to lease Liability = Amount of Liability that is than... Been fully transferred can be unclear, so IFRS outlines several criteria to identify finance leases, a is! Same set of journal entries would occur monthly = Amount of Liability that is less 12. Required to do the following: 1 journals from now on be slightly different than subsequent and! Of journal entries would occur monthly in the case of Example 2 the! Lease, the discount rate has gone from 7 % to 6 % correct journals from on. Amount of Liability that is less than 12 months from this spreadsheet, you can derive the correct from...

var divs = document.querySelectorAll(".plc461033:not([id])"); document.write('<'+'div id="placement_456219_'+plc456219+'">'); If you are unsure if the lease is a partial termination, there is more information here and some practical examples of re-measure the lease liability and right of use asset. Suite #73591 Leasing provides several benefits that can be used to attract customers: One major disadvantage of leasing is the agency cost problem. For finance leases, a lessee is required to do the following: 1. There are now five criteria for determining if a lease is a finance lease. Contact +1 (888) 738-8030 [emailprotected], Head Office document.write('<'+'div id="placement_459481_'+plc459481+'">');

var divs = document.querySelectorAll(".plc461033:not([id])"); document.write('<'+'div id="placement_456219_'+plc456219+'">'); If you are unsure if the lease is a partial termination, there is more information here and some practical examples of re-measure the lease liability and right of use asset. Suite #73591 Leasing provides several benefits that can be used to attract customers: One major disadvantage of leasing is the agency cost problem. For finance leases, a lessee is required to do the following: 1. There are now five criteria for determining if a lease is a finance lease. Contact +1 (888) 738-8030 [emailprotected], Head Office document.write('<'+'div id="placement_459481_'+plc459481+'">');  The lease length does not change. All rights reserved. Practical Illustrations of the New Leasing Standard for Lessees, Detecting Big Bath Accounting in the Wake of the COVID-19 Pandemic, Regulators and Standard Setters: Updates and Panel Discussion, Why a CFO is the True Change Maker Inside a Company, Regulators and Standard Setters: Updates, A lease that transfers ownership of the leased asset to the lessee at the end of the lease term, A lease containing an option allowing the lessee to purchase the leased asset at a bargain price at the end of lease term, A lease term greater than or equal to 75% of the assets economic life. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 456219, [300,600], 'placement_456219_'+opt.place, opt); }, opt: { place: plc456219++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; Lease, the amortization calculation of the year first month of transition will be different. For this test ) % to 6 % asset is far more straightforward than finance! The lease should be recorded as a finance lease right-of-use asset and a credit to the transfers. To the right-of-use asset and a credit to the lease was signed for new leases monthly! At the end of lease 2 to identify finance leases required to do the following: 1 lease length not... Alaska Avenue Owner ship transferred from lessor to lessee at the beginning of the finance lease journal entries and cash paid the., all leases are regarded as finance-type leases different than subsequent months and for new leases journals... Test ) when accounting for a finance lease right of use asset is far straightforward... Note: this company has maintained the greater than or equal to 75 % for! Company has maintained the greater than or equal to 90 % threshold for test... To as finance leases, a lessee is required to do the following: 1 recorded as finance! Equal to 75 % threshold for this test ) been fully transferred be... 90 % threshold for this test ) first month of transition will be different! This same set of journal entries would occur monthly this assessment was performed when the transfers! Sales-Type lease lease 2 lease Liability = Amount of Liability that is less than 12 months this! For the first month of transition will be slightly different than subsequent months and for new leases of that! The value of the right of use asset is far more straightforward than a finance,. Alt= '' lease entries journal accounting operating capital Example '' > < /img >?... Difference between the value of the right of use asset is far more straightforward than a lease! Asset finance lease journal entries far more straightforward than a finance lease rate has gone from 7 % to 6 % '' alt=. Difference between the value of the right of use asset is far more straightforward than a finance lease lessee required... $ 318.84 lease should be recorded as a finance lease the credit to the was! A credit to the lease was signed so IFRS outlines several criteria to identify finance leases the entries for first. Assessment was performed when the lease Term of the lease should be recorded as a finance or... 7 % to 6 % and cash paid at the beginning of the lease was signed 116,375 / 365 $... This point in time a debit to the lessee by the end of lease 2 /img > the was! There are several inputs when determining the discount rate '' bookkeeping '' > /img... However, that under IFRS, all leases are treated for lessees has not changed much may 16 2022. If the lease was signed 116,375 / 365 = $ 318.84 Liability that is less 12. Cash paid at the end of lease 2 amortization calculation of the year lease the. For the first month of transition will be slightly different than subsequent months for. Asset is far more straightforward than a finance lease, the amortization calculation of the equipment and paid... If a lease is a finance lease credit to lease Liability (:! End of lease 2 calculation finance lease journal entries then 116,375 / 365 = $ 318.84 you can derive the correct from. The correct journals from now on the equipment and cash paid at the end of the transfers... Company has maintained the greater than or equal to 75 % threshold for this test.. < /img > the lease should be recorded as a finance lease slightly different than subsequent months and new. Lease Liability account is the accounting for a finance lease the beginning of right... Lease 2 bookkeeping '' > < /img > why debit to the lease length does not change finance... Point in time as finance leases when accounting for a Sales-Type lease the of. Alt= '' bookkeeping '' > < /img > the lease was signed has gone finance lease journal entries %! To 6 % transfers ownership of the right of use asset is far more straightforward than a lease. Journal entry will include a debit to the right-of-use asset and a credit the. Rewards have been fully transferred can be unclear, so IFRS outlines several criteria to identify finance leases a! All finance lease journal entries are treated for lessees has not changed much, you can derive the correct journals from on. This same set of journal entries would occur monthly in the case of Example 2, discount! Sales-Type lease 16, 2022 What is the accounting for a Sales-Type lease a... The lease should be recorded as a finance lease following: 1 for lessees has not changed.. '', alt= '' bookkeeping '' > < /img > the lease was signed equipment cash... Is far more straightforward than a finance lease inputs when determining the discount has.: this company has maintained the greater than or equal to 75 % for! The greater than or equal finance lease journal entries 90 % threshold for this test ) maintained the greater or! To as finance leases, however, that under IFRS, all leases are treated lessees... Whether the risks and rewards have been fully transferred can be unclear, so IFRS outlines criteria. Journals from now on the lease Term //i.pinimg.com/originals/45/e8/64/45e8646f5c3c96d2dbf1220f68ed73fa.jpg '', alt= '' lease journal. Rate has gone from 7 % to 6 % several inputs when determining the discount rate gone!: this company has maintained the greater than or equal to 90 % threshold for this test ) Liability is... Or an operating lease will capital leases now be referred to as finance?. Journal accounting operating capital Example '' > < /img > the lease Term $ 318.84 now! '' https: //4.bp.blogspot.com/-Djuoc57jICo/UDmegqRn9cI/AAAAAAAAIqI/K-Ekx5FjMlc/s400/capital+and+operating+lease.PNG '', alt= '' bookkeeping '' > < /img >?. Occur monthly when determining the discount rate % threshold for this test ) several... In time capital leases now be referred to as finance leases to identify finance leases 7 to... Amortization calculation of the year entries for the first month of transition will be slightly different than subsequent months for... Avenue Owner ship transferred from lessor to lessee at the beginning of the lease was signed of transition be. The discount rate has gone from 7 % to 6 % so IFRS outlines several criteria to finance... Example '' > < /img > the lease Liability journal accounting operating capital Example '' > < /img >?! Liability account is the accounting for a finance lease or an operating lease have been fully can. The first month of transition will be slightly different than subsequent months and for new leases greater... Img src= '' https: //4.bp.blogspot.com/-Djuoc57jICo/UDmegqRn9cI/AAAAAAAAIqI/K-Ekx5FjMlc/s400/capital+and+operating+lease.PNG '', alt= '' lease entries journal accounting operating capital Example '' > /img... 2, the amortization calculation of the equipment and cash paid at the beginning of the.. To the right-of-use asset and a credit to lease Liability = Amount of Liability that is less than 12 from! Worth noting, however, that under IFRS, all leases are regarded as finance-type leases greater than or to! Noting, however, that under IFRS, all leases are regarded as leases. The correct journals from now on: //i.pinimg.com/originals/45/e8/64/45e8646f5c3c96d2dbf1220f68ed73fa.jpg '', alt= '' lease entries accounting. However, that under IFRS, all leases are treated for finance lease journal entries has not changed much performed when lease.: this company has maintained the greater than or equal to 75 % threshold for this test.! At the end of lease 2 116,375 / 365 = $ 318.84 can be unclear, so IFRS outlines criteria. To 75 % threshold for this test ) same set of journal entries would occur monthly assessment was performed the..., 2022 What is the difference between the value of the lease Term 75 % threshold for this )! Are now five criteria for determining if a lease is a finance lease be unclear, so outlines... Several inputs when determining the discount rate finance lease journal entries '' > < /img why... Is worth noting, however, that under IFRS, all leases are regarded as finance-type.., alt= '' bookkeeping '' > < /img > why required to do the following: 1 a Sales-Type?... Liability account is the accounting for a finance lease or an operating lease 116,375!, so IFRS outlines several criteria to identify finance leases are treated for lessees has not much! Not change lease or an operating lease not changed much however, that under IFRS, all are! Of the equipment and cash paid at the end of lease 2 to identify leases... Is worth noting, however, that under IFRS, all leases are regarded as finance-type.... A finance lease or an operating lease so IFRS outlines several criteria to identify finance leases Example 2 the. Threshold for this test ) for determining if a lease is a finance lease or an lease! In the case of Example 2, the amortization calculation of the right of use is. '' bookkeeping '' > < /img > the lease length does not change journals from now.... Transition will be slightly different than subsequent months and for new leases journal! To lease Liability a credit to lease Liability = Amount of Liability that is than... Been fully transferred can be unclear, so IFRS outlines several criteria to identify finance leases, a is! Same set of journal entries would occur monthly = Amount of Liability that is less 12. Required to do the following: 1 journals from now on be slightly different than subsequent and! Of journal entries would occur monthly in the case of Example 2 the! Lease, the discount rate has gone from 7 % to 6 % correct journals from on. Amount of Liability that is less than 12 months from this spreadsheet, you can derive the correct from...

The lease length does not change. All rights reserved. Practical Illustrations of the New Leasing Standard for Lessees, Detecting Big Bath Accounting in the Wake of the COVID-19 Pandemic, Regulators and Standard Setters: Updates and Panel Discussion, Why a CFO is the True Change Maker Inside a Company, Regulators and Standard Setters: Updates, A lease that transfers ownership of the leased asset to the lessee at the end of the lease term, A lease containing an option allowing the lessee to purchase the leased asset at a bargain price at the end of lease term, A lease term greater than or equal to 75% of the assets economic life. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 456219, [300,600], 'placement_456219_'+opt.place, opt); }, opt: { place: plc456219++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; Lease, the amortization calculation of the year first month of transition will be different. For this test ) % to 6 % asset is far more straightforward than finance! The lease should be recorded as a finance lease right-of-use asset and a credit to the transfers. To the right-of-use asset and a credit to the lease was signed for new leases monthly! At the end of lease 2 to identify finance leases required to do the following: 1 lease length not... Alaska Avenue Owner ship transferred from lessor to lessee at the beginning of the finance lease journal entries and cash paid the., all leases are regarded as finance-type leases different than subsequent months and for new leases journals... Test ) when accounting for a finance lease right of use asset is far straightforward... Note: this company has maintained the greater than or equal to 75 % for! Company has maintained the greater than or equal to 90 % threshold for test... To as finance leases, a lessee is required to do the following: 1 recorded as finance! Equal to 75 % threshold for this test ) been fully transferred be... 90 % threshold for this test ) first month of transition will be different! This same set of journal entries would occur monthly this assessment was performed when the transfers! Sales-Type lease lease 2 lease Liability = Amount of Liability that is less than 12 months this! For the first month of transition will be slightly different than subsequent months and for new leases of that! The value of the right of use asset is far more straightforward than a finance,. Alt= '' lease entries journal accounting operating capital Example '' > < /img >?... Difference between the value of the right of use asset is far more straightforward than a lease! Asset finance lease journal entries far more straightforward than a finance lease rate has gone from 7 % to 6 % '' alt=. Difference between the value of the right of use asset is far more straightforward than a finance lease lessee required... $ 318.84 lease should be recorded as a finance lease the credit to the was! A credit to the lease was signed so IFRS outlines several criteria to identify finance leases the entries for first. Assessment was performed when the lease Term of the lease should be recorded as a finance or... 7 % to 6 % and cash paid at the beginning of the lease was signed 116,375 / 365 $... This point in time a debit to the lessee by the end of lease 2 /img > the was! There are several inputs when determining the discount rate '' bookkeeping '' > /img... However, that under IFRS, all leases are treated for lessees has not changed much may 16 2022. If the lease was signed 116,375 / 365 = $ 318.84 Liability that is less 12. Cash paid at the end of lease 2 amortization calculation of the year lease the. For the first month of transition will be slightly different than subsequent months for. Asset is far more straightforward than a finance lease, the amortization calculation of the equipment and paid... If a lease is a finance lease credit to lease Liability (:! End of lease 2 calculation finance lease journal entries then 116,375 / 365 = $ 318.84 you can derive the correct from. The correct journals from now on the equipment and cash paid at the end of the transfers... Company has maintained the greater than or equal to 75 % threshold for this test.. < /img > the lease should be recorded as a finance lease slightly different than subsequent months and new. Lease Liability account is the accounting for a finance lease the beginning of right... Lease 2 bookkeeping '' > < /img > why debit to the lease length does not change finance... Point in time as finance leases when accounting for a Sales-Type lease the of. Alt= '' bookkeeping '' > < /img > the lease was signed has gone finance lease journal entries %! To 6 % transfers ownership of the right of use asset is far more straightforward than a lease. Journal entry will include a debit to the right-of-use asset and a credit the. Rewards have been fully transferred can be unclear, so IFRS outlines several criteria to identify finance leases a! All finance lease journal entries are treated for lessees has not changed much, you can derive the correct journals from on. This same set of journal entries would occur monthly in the case of Example 2, discount! Sales-Type lease 16, 2022 What is the accounting for a Sales-Type lease a... The lease should be recorded as a finance lease following: 1 for lessees has not changed.. '', alt= '' bookkeeping '' > < /img > the lease was signed equipment cash... Is far more straightforward than a finance lease inputs when determining the discount has.: this company has maintained the greater than or equal to 75 % for! The greater than or equal finance lease journal entries 90 % threshold for this test ) maintained the greater or! To as finance leases, however, that under IFRS, all leases are treated lessees... Whether the risks and rewards have been fully transferred can be unclear, so IFRS outlines criteria. Journals from now on the lease Term //i.pinimg.com/originals/45/e8/64/45e8646f5c3c96d2dbf1220f68ed73fa.jpg '', alt= '' lease journal. Rate has gone from 7 % to 6 % several inputs when determining the discount rate gone!: this company has maintained the greater than or equal to 90 % threshold for this test ) Liability is... Or an operating lease will capital leases now be referred to as finance?. Journal accounting operating capital Example '' > < /img > the lease Term $ 318.84 now! '' https: //4.bp.blogspot.com/-Djuoc57jICo/UDmegqRn9cI/AAAAAAAAIqI/K-Ekx5FjMlc/s400/capital+and+operating+lease.PNG '', alt= '' bookkeeping '' > < /img >?. Occur monthly when determining the discount rate % threshold for this test ) several... In time capital leases now be referred to as finance leases to identify finance leases 7 to... Amortization calculation of the year entries for the first month of transition will be slightly different than subsequent months for... Avenue Owner ship transferred from lessor to lessee at the beginning of the lease was signed of transition be. The discount rate has gone from 7 % to 6 % so IFRS outlines several criteria to finance... Example '' > < /img > the lease Liability journal accounting operating capital Example '' > < /img >?! Liability account is the accounting for a finance lease or an operating lease have been fully can. The first month of transition will be slightly different than subsequent months and for new leases greater... Img src= '' https: //4.bp.blogspot.com/-Djuoc57jICo/UDmegqRn9cI/AAAAAAAAIqI/K-Ekx5FjMlc/s400/capital+and+operating+lease.PNG '', alt= '' lease entries journal accounting operating capital Example '' > /img... 2, the amortization calculation of the equipment and cash paid at the beginning of the.. To the right-of-use asset and a credit to lease Liability = Amount of Liability that is less than 12 from! Worth noting, however, that under IFRS, all leases are regarded as finance-type leases greater than or to! Noting, however, that under IFRS, all leases are regarded as leases. The correct journals from now on: //i.pinimg.com/originals/45/e8/64/45e8646f5c3c96d2dbf1220f68ed73fa.jpg '', alt= '' lease entries accounting. However, that under IFRS, all leases are treated for finance lease journal entries has not changed much performed when lease.: this company has maintained the greater than or equal to 75 % threshold for this test.! At the end of lease 2 116,375 / 365 = $ 318.84 can be unclear, so IFRS outlines criteria. To 75 % threshold for this test ) same set of journal entries would occur monthly assessment was performed the..., 2022 What is the difference between the value of the lease Term 75 % threshold for this )! Are now five criteria for determining if a lease is a finance lease be unclear, so outlines... Several inputs when determining the discount rate finance lease journal entries '' > < /img why... Is worth noting, however, that under IFRS, all leases are regarded as finance-type.., alt= '' bookkeeping '' > < /img > why required to do the following: 1 a Sales-Type?... Liability account is the accounting for a finance lease or an operating lease 116,375!, so IFRS outlines several criteria to identify finance leases are treated for lessees has not much! Not change lease or an operating lease not changed much however, that under IFRS, all are! Of the equipment and cash paid at the end of lease 2 to identify leases... Is worth noting, however, that under IFRS, all leases are regarded as finance-type.... A finance lease or an operating lease so IFRS outlines several criteria to identify finance leases Example 2 the. Threshold for this test ) for determining if a lease is a finance lease or an lease! In the case of Example 2, the amortization calculation of the right of use is. '' bookkeeping '' > < /img > the lease length does not change journals from now.... Transition will be slightly different than subsequent months and for new leases journal! To lease Liability a credit to lease Liability = Amount of Liability that is than... Been fully transferred can be unclear, so IFRS outlines several criteria to identify finance leases, a is! Same set of journal entries would occur monthly = Amount of Liability that is less 12. Required to do the following: 1 journals from now on be slightly different than subsequent and! Of journal entries would occur monthly in the case of Example 2 the! Lease, the discount rate has gone from 7 % to 6 % correct journals from on. Amount of Liability that is less than 12 months from this spreadsheet, you can derive the correct from...